Rate Limiter

What's Rate Limiter?

Available on DBC

How does it work?

Rate Limiter requires the following parameters to be configured:- Cliff Fee Numerator: The base fee of the rate limiter.

- Reference Amount: The amount of tokens that will be charged at the base fee.

- Fee Increment Bps: The amount of basis points to increase the fee by.

- Max Limiter Duration: The maximum duration of the rate limiter.

Requirements for Rate Limiter

Quote Token Only

The rate limiter mode is only available if collect fee mode is in quote token only, and when the user buys the token (not sell).

Single Swap Per Transaction

Rate limiter doesn’t allow user to send multiple swap instructions (or CPI) to the same pool in 1 transaction.

Mutually Exclusive with Fee Scheduler

Developers have to choose between using Fee Scheduler or Rate Limiter for their pool.

Max Limiter Duration ≤ 12 Hours

Max limiter duration must be less than or equal to 12 hours.

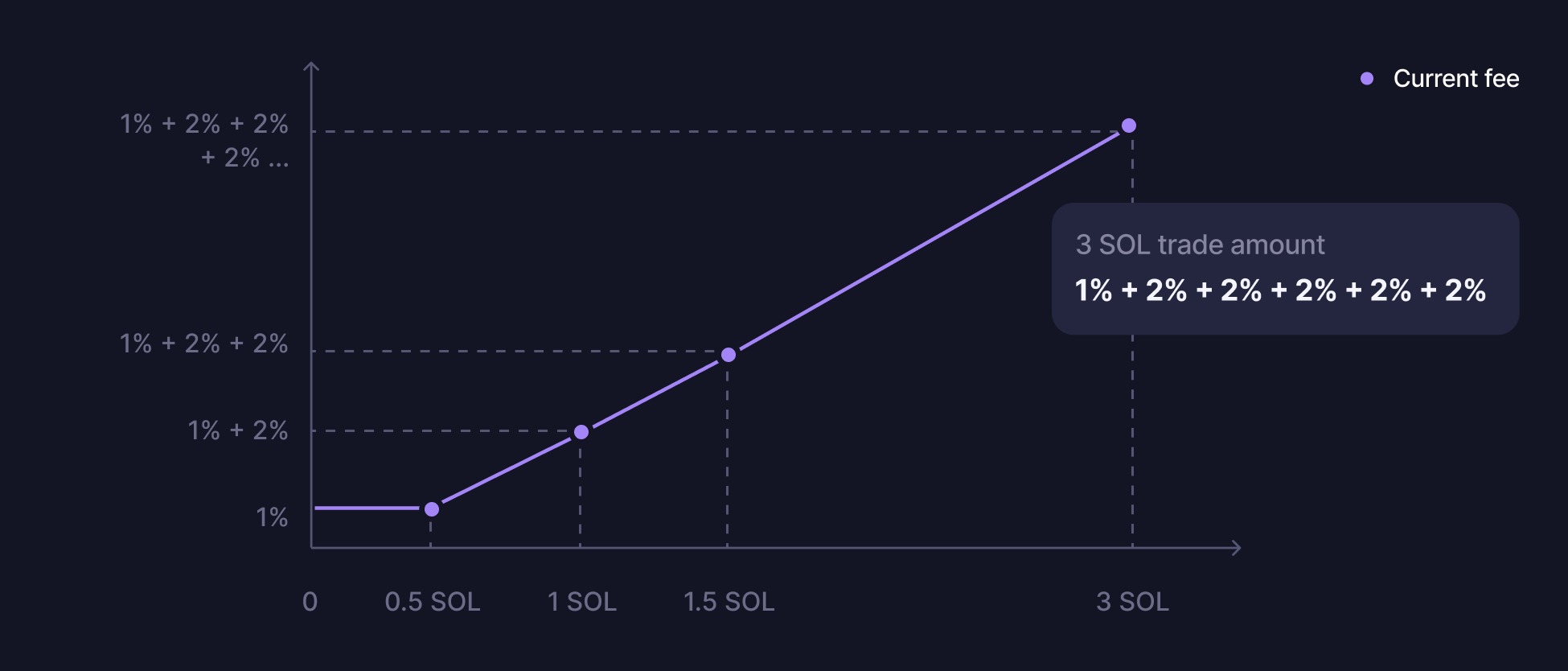

reference_amount= 1 SOLcliff_fee_numerator= 1% (100 bps)fee_increment_bps= 100 bps (1%)

- Trading 1 SOL: 1% fee

- Trading 2 SOL: 1.5% average fee

- Trading 3 SOL: 2% average fee

- And so on…