Programs

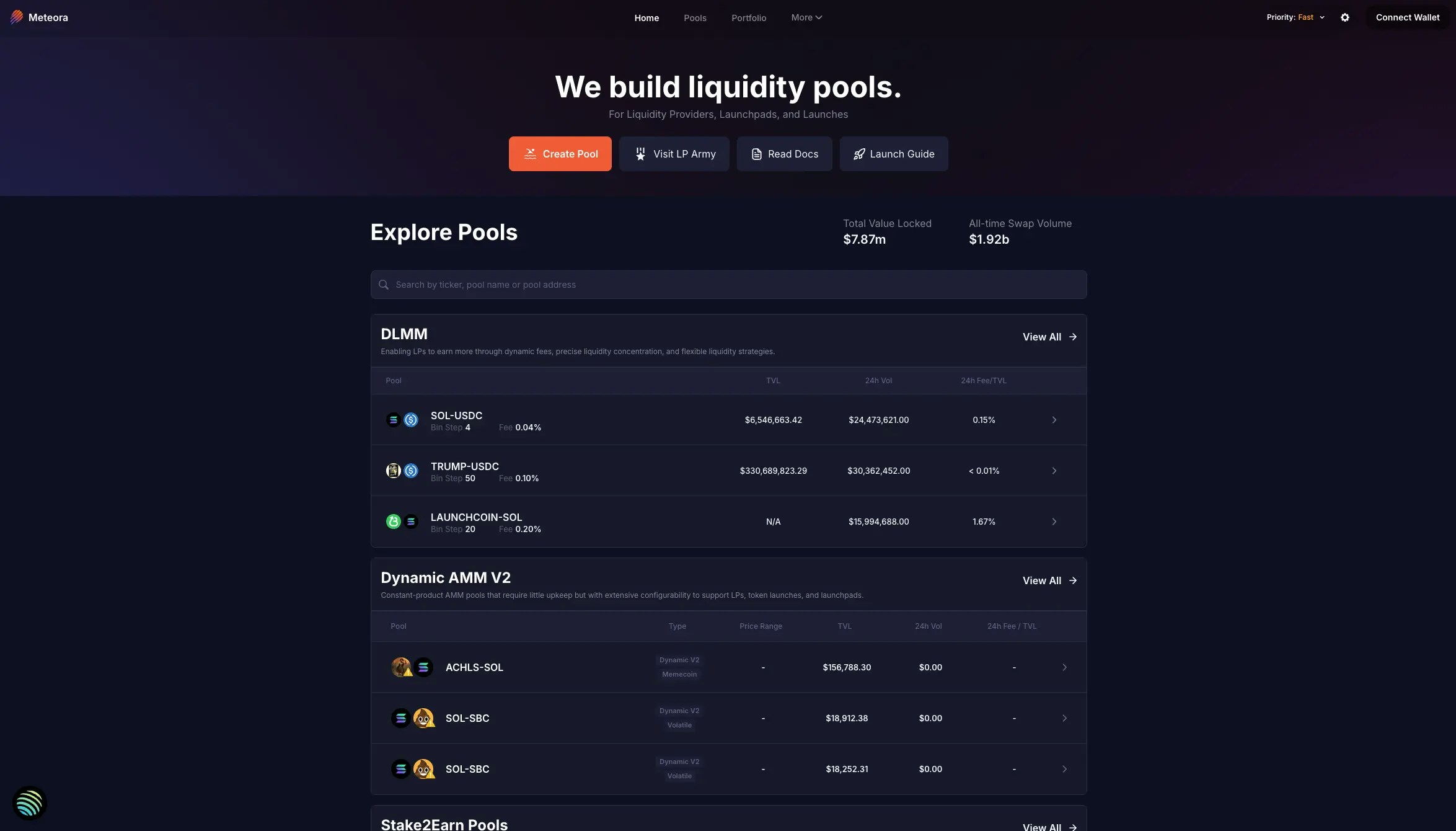

We write innovative programs that power the future of DeFi. With novel products like DLMM, DAMM v1 & v2, DBC and more, we are pushing the boundaries of what is possible on Solana.Active Programs

Active = will have new developments and still actively maintained| Program | Program ID | Open Source |

|---|---|---|

| DLMM | LBUZKhRxPF3XUpBCjp4YzTKgLccjZhTSDM9YuVaPwxo | ❌ |

| DAMM v2 | cpamdpZCGKUy5JxQXB4dcpGPiikHawvSWAd6mEn1sGG | ✅ |

| DBC | dbcij3LWUppWqq96dh6gJWwBifmcGfLSB5D4DuSMaqN | ✅ |

| Presale Vault [Beta] | presSVxnf9UU8jMxhgSMqaRwNiT36qeBdNeTRKjTdbj | ✅ |

| Alpha Vault | vaU6kP7iNEGkbmPkLmZfGwiGxd4Mob24QQCie5R9kd2 | ❌ |

| Dynamic Fee Sharing | dfsdo2UqvwfN8DuUVrMRNfQe11VaiNoKcMqLHVvDPzh | ✅ |

| Zap | zapvX9M3uf5pvy4wRPAbQgdQsM1xmuiFnkfHKPvwMiz | ✅ |

Legacy Programs

Legacy = will not have new developments but still maintained| Program | Program ID | Open Source |

|---|---|---|

| DAMM v1 | Eo7WjKq67rjJQSZxS6z3YkapzY3eMj6Xy8X5EQVn5UaB | ❌ |

| Dynamic Vault | 24Uqj9JCLxUeoC3hGfh5W3s9FM9uCHDS2SG3LYwBpyTi | ❌ |

| Stake2Earn | FEESngU3neckdwib9X3KWqdL7Mjmqk9XNp3uh5JbP4KP | ❌ |

| Farm | FarmuwXPWXvefWUeqFAa5w6rifLkq5X6E8bimYvrhCB1 | ❌ |

| Mercurial Stable Swap | MERLuDFBMmsHnsBPZw2sDQZHvXFMwp8EdjudcU2HKky | ❌ |

Devnet

Our programs are deployed on devnet as well at https://devnet.meteora.ag.

Quick Launch

Quick Launch abstracts the need for understanding Meteora integration complexities by providing an all-in-one interface that any developer can use to create, enter commands and deploy liquidity pools on Solana.DLMM

Configure and launch a concentrated liquidity DLMM pool with or without Alpha Vault on Meteora in just a few quick and easy steps.

DAMM v2

Configure and launch a balanced or one-sided DAMM v2 pool with or without Alpha Vault on Meteora in just a few quick and easy steps.

DAMM v1

Configure and launch a freshly minted DAMM v1 pool with or without Alpha Vault on Meteora in just a few quick and easy steps.

Dynamic Bonding Curve

Configure and launch an entirely new dynamic bonding curve pool on Meteora in just a few quick and easy steps.

Invent with Metsumi

Meteora Invent is a playground for developers to quickly test and experiment with Meteora’s programs. Metsumi is your personal launch assistant engineered to help you launch anything and do any action in just a few configurations and CLI commands.

Guides

DLMM

DLMM (Dynamic Liquidity Market Maker) implements a bin-based liquidity distribution model with algorithmic fee adjustment mechanisms based on market volatility metrics. Liquidity providers can deploy capital across discrete price bins with configurable spreads, enabling concentrated liquidity positioning with real-time fee optimization through volatility-sensitive pricing algorithms.

DAMM v2

DAMM v2 (Dynamic Automatic Market Maker v2) implements a constant-product invariant (x*y=k) with enhanced features including SPL/Token-2022 compatibility, optional concentrated liquidity ranges, position NFTs, algorithmic onchain fee scheduling, programmable fee distribution mechanisms, and native yield farming integration.

DAMM v1

DAMM v1 (Dynamic Automatic Market Maker v1) utilizes a constant-product formula with infinite price range support (0 < P < ∞) and integrated yield aggregation through external lending protocol interfaces. The architecture enables composite yield generation via swap fee accrual and external DeFi protocol interaction, with automated capital efficiency optimization.

Dynamic Bonding Curve

Dynamic Bonding Curve (DBC) implements customizable mathematical pricing functions with configurable curve parameters for token launch mechanisms. The protocol supports arbitrary curve geometries with programmable price discovery algorithms, featuring virtual AMM states that migrate to dynamic AMM pools upon reaching predetermined liquidity thresholds through automated graduation logic.

Presale Vault [Beta]

Presale Vault allows users to contribute using any SPL token and later claim their allocated presale tokens once the presale concludes. Presale vault creators can choose to create a presale vault with a fixed price, FCFS or Prorata mode, and a whitelist of addresses. Creators can also classify different tiers of participants with different token allocations, minimum and maximum deposit amounts, and deposit fees.

Dynamic Vault

Dynamic Vaults implement algorithmic yield optimization through multi-protocol asset allocation strategies, utilizing the Hermes yield aggregation engine for automated capital deployment across lending markets. The system employs mathematical optimization algorithms to maximize risk-adjusted returns for DAMM v1 and memecoin pool liquidity providers through dynamic rebalancing mechanisms.

Alpha Vault

Alpha Vault implements a complementary anti-bot mechanism for token launches, providing early access for genuine supporters to deposit and purchase tokens before public trading begins. The system features configurable parameters including deposit caps, lock-up periods, and vesting schedules, with support for both pro-rata and FCFS distribution modes across DLMM, DAMM v1, and DAMM v2 launch pools.

Stake2Earn

Stake2Earn is a mechanism where top memecoin stakers compete to earn fee rewards from permanently-locked liquidity in the memecoin pool, transforming memecoins from a race to dump to a race to stake.

Dynamic Fee Sharing

Dynamic Fee Sharing is a helper program that allows for the creation of fee vaults where collected fees can be automatically distributed among multiple recipients based on predetermined share allocations.

Zap

Zap is a wrapper program that provides utility functions that allow users to zap in/out from any AMMs or Jupiter. For example, a user can claim both token fee rewards and immediately swap any of the token through DAMM v2, DLMM or Jupiter to receive the other token.