What’s a Dynamic Bonding Curve?

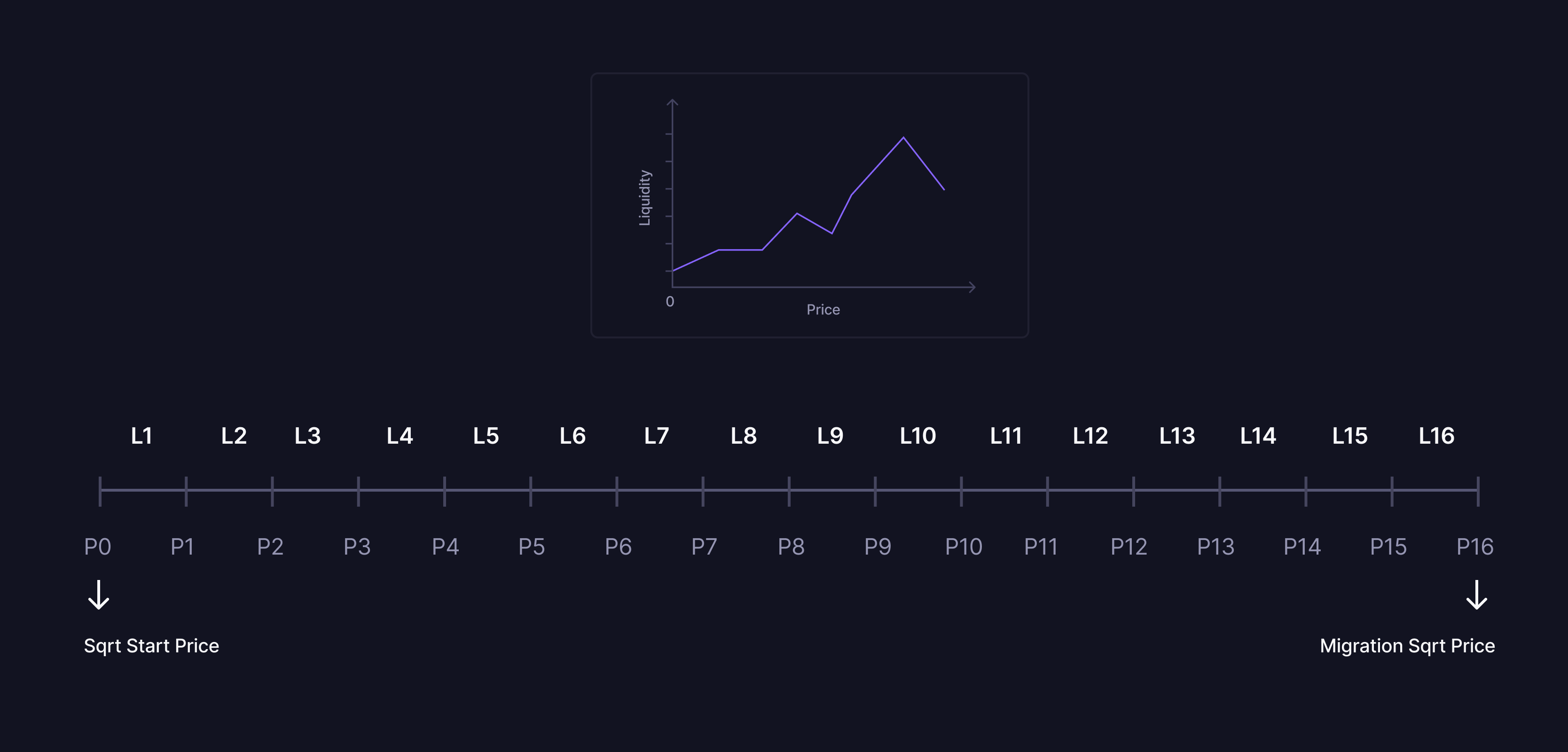

A Dynamic Bonding Curve is a Universal Curve — an up to 16-point customizable curve system that revolutionizes how liquidity providers can design their strategies. This curve is fully customizable for any launchpad to craft their own unique bonding curve.Each curve point in the Dynamic Bonding Curve is a constant product curve that can be configured to control the token’s price action.

The Problem with Traditional AMMs

Traditional AMMs have been constrained by rigid curve designs:- Capital Inefficiency: Uniswap V2’s constant product spreads liquidity equally across all prices, leaving most capital unused

- One-Size-Fits-All: Current AMMs force all LPs in a pool to follow the same curve design

- Limited Flexibility: Even concentrated liquidity solutions force LPs into predefined ranges

How Universal Curve Solves This

Universal Curve enables unprecedented flexibility through:16-Point Customization

LPs can define up to 16 points along their desired curve, with constant product formula providing smooth transitions between points.

Infinite Range Capability

Unlike range-based solutions, Universal Curve allows LPs to provide liquidity from 0 to infinity while concentrating capital exactly where needed.

Multiple Strategies in One Pool

Different LPs can use different curve strategies within the same pool — StableSwap efficiency, constant product flexibility, or custom combinations.

Recreate Any AMM Design

Universal Curve can replicate Uniswap V2, Curve StableSwap, or create entirely custom strategies tailored to specific needs.

How does it work?

Partner creates a unique config key

Partners (launchpads) create a unique configuration key that includes all settings that covers from the Dynamic Bonding Curve creation to the migration of the liquidity to the actual DAMM pool.

Creators create DBC token pools

Creators (token pool creators) can create a Dynamic Bonding Curve token pool using the partner’s config key. This will mint a new token.

You cannot create a DBC token pool with an existing token.

Trading platforms can swap

Trading platforms and trading bots (e.g., Jupiter, Axiom, Photon, etc.) can immediately swap with the Dynamic Bonding Curve pool.

DBC reaches minimum quote threshold

When the DBC pool reaches a pre-defined minimum quote threshold (specified in the config key), no one can swap with that pool anymore and that pool is prepared for migration.

Meteora auto migrator service creates a DAMM pool

Meteora’s auto migrator keeper service then migrates the DBC pool by sending a crank to create a new Meteora Dynamic AMM v1 or v2 pool

LP tokens or NFTs are distributed to partner and creator

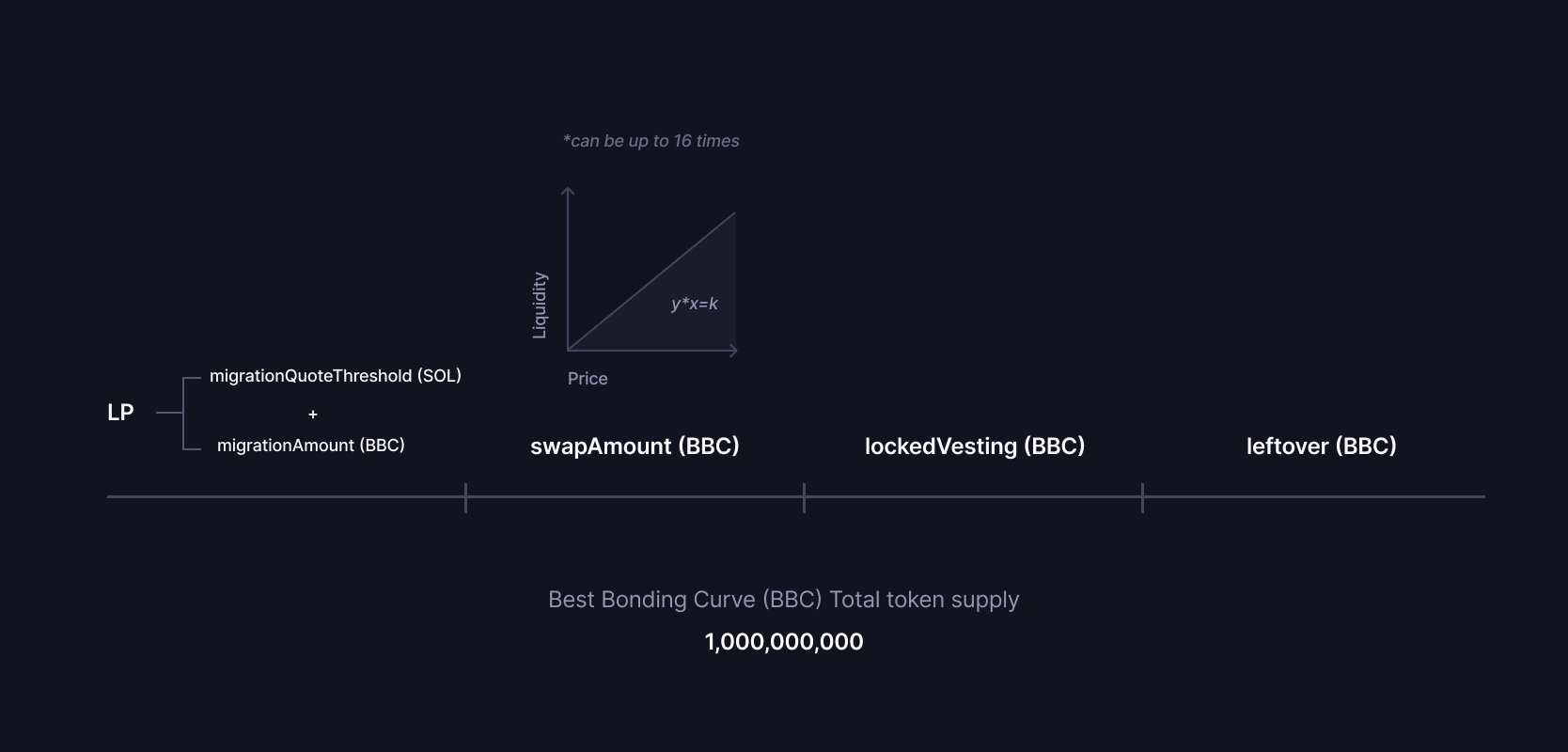

Upon migration, the liquidity is distributed to the partner and creator based on the config key settings. The LP is split into three categories:1. Claimable LP (

partnerLiquidityPercentage, creatorLiquidityPercentage)- Immediately withdrawable by the partner or creator after migration

- For DAMM v1: LP tokens sent to the partner/creator wallet

- For DAMM v2: NFT positions owned by the partner (

feeClaimer) or creator (poolCreator)

partnerPermanentLockedLiquidityPercentage, creatorPermanentLockedLiquidityPercentage)- Locked forever in the graduated pool and can never be withdrawn

- Partner/creator can still claim trading fees from permanently locked positions

partnerLiquidityVestingInfo, creatorLiquidityVestingInfo)- LP that vests over time based on a configured schedule

- Includes cliff duration, vesting periods, and release frequency

- Gradually becomes claimable as the vesting schedule progresses

A minimum of 10% liquidity must remain locked at day 1 post-migration (via permanent locks and/or vesting).

Key Benefits

Customizable Launch Pools

Launch partners can configure their launch pools with customizable quote tokens (e.g., SOL, USDC, JUP), unique bonding curves for token graduation, flexible fee structures, and more.

Seamless Token Creation

Users can easily create tokens and launch pools using partner-defined configurations directly from the partner’s UI.

Instant Trading Integration

Trading platforms and bots can immediately access and trade these tokens through our direct integrations with Jupiter and other platforms.

Graduation to AMMs & Fee Claiming

Tokens can graduate to supported AMMs (currently Meteora DAMM v1 and v2) based on partner settings. Launchers can claim fees from locked LP tokens.

Full End-to-End API Support

Comprehensive Charting, Trading and Transactions API support enables easy integration for launch partners, trading platforms, and bots.

Anti-Sniper Features

Fee Time Scheduler

Timestamp-based fees, such as high fees at launch that decrease over time, help deter snipers and protect the pool during the most volatile periods.

Rate Limiter

Amount-based fees that increases with a higher amount per swap, to deter snipers from sniping large amounts of tokens, while protecting smaller retail traders.

Other Features

Multiple Quote Token Support

Supports SOL, USDC, JUP, and other quote tokens for maximum flexibility.

SPL Token & Token2022 Support

Compatible with both SPL Token and Token2022 standards for broad token compatibility.

Flexible Fee Collection Modes

Choose to collect fees only in the quote token or keep a percentage of all fees generated on the Dynamic Bonding Curve.

Customizable Liquidity Distribution

Configure up to 16 price ranges with different liquidity curves for advanced pool customization.

Pool Creation Fee

Partners can configure a SOL fee charged to token creators when creating pools. Partners can claim these fees via the SDK.

LP Vesting (DAMM v2)

Configure vesting schedules for partner and creator LP positions after migration to DAMM v2.

Customizable Fees

The Dynamic Bonding Curve (DBC) virtual pool collects a trading fee on every trade (buy or sell).-

Protocol Fee:

A portion of each trading fee is allocated to the DBC protocol (Fixed 20% of the trading fee). -

Referral Fee:

Swap hosts (such as Jupiter, Photon, or trading bots) can include a referral account in the swap transaction to receive a referral fee, which is taken from the protocol fee (Fixed 20% of the protocol fee). -

Fee Sharing in the Bonding Curve:

The remaining trading fee is distributed to the launch partner (Fixed 80% of the trading fee). This fee can be fee shared between the partner and the token creator. -

Fee Distribution After Migration:

Once a token has graduated, the LP tokens are locked for both the partner and the token creator. The ratio of locked LP tokens is determined by the partner’s configuration. Both the partner and the token creator can claim fees from these locked LP tokens on Meteora DAMM v1 or DAMM v2.

Migration

Automatic Migration

If the DBC pool reaches a pre-defined quote token or price threshold, the liquidity is automatically migrated to a DAMM v1 pool or DAMM v2 Pool on Meteora. We run 2 auto migrator keepers to migrate DBC pools. These 2 keepers have strict migration quote threshold requirements. Keeper addresses that we are running:pool_config.migration_quote_thresholdrequirements:- 10 SOL

- 750 USDC

- 1500 JUP

pool_config.migration_quote_thresholdrequirements:- >= 750 USD (

quote_minttoken)

- >= 750 USD (

The Migration Keepers only runs on Mainnet.

Manual Migration

We have built a manual migration user interface for launchpads building on DBC to easily test the migration process.The Manual Migrator supports both Mainnet and Devnet.